DENVER, CO – 12/03/2026 – (SeaPRwire) – As financial institutions explore ways to integrate digital assets into their payment infrastructure, new collaborations between fintech providers are emerging to bridge traditional banking systems with blockchain-based technologies. In this context, digital-asset solutions provider Omnia has announced a strategic partnership with banking platform company Infinant to enhance stablecoin payment functionality within the Interlace Banking and Payments Platform.

The partnership aims to provide banks with a unified payment framework capable of supporting both conventional fiat transactions and regulated stablecoin-based transfers. By combining legacy banking rails with blockchain-enabled settlement capabilities, the collaboration seeks to create a modern payment hub designed to support evolving financial services.

Stablecoins Gaining Momentum in Financial Services

As interest in digital assets continues to expand, stablecoins and tokenized deposits are increasingly being explored by financial institutions as tools for improving payment efficiency and expanding service offerings. Stablecoins, which are typically designed to maintain a stable value relative to fiat currencies, are being considered for applications such as cross-border payments, interbank settlement, and real-time transaction processing.

These digital assets offer the potential to streamline international money transfers, reduce settlement times, and support financial services that operate continuously rather than within traditional banking hours.

Davis Hart, CEO and Founder of Omnia, noted that the partnership reflects a shared vision between the two companies regarding the evolution of banking infrastructure. According to Hart, the future financial ecosystem will likely involve multiple types of assets and payment rails operating together within unified platforms.

Integrating Digital Asset Infrastructure for Banks

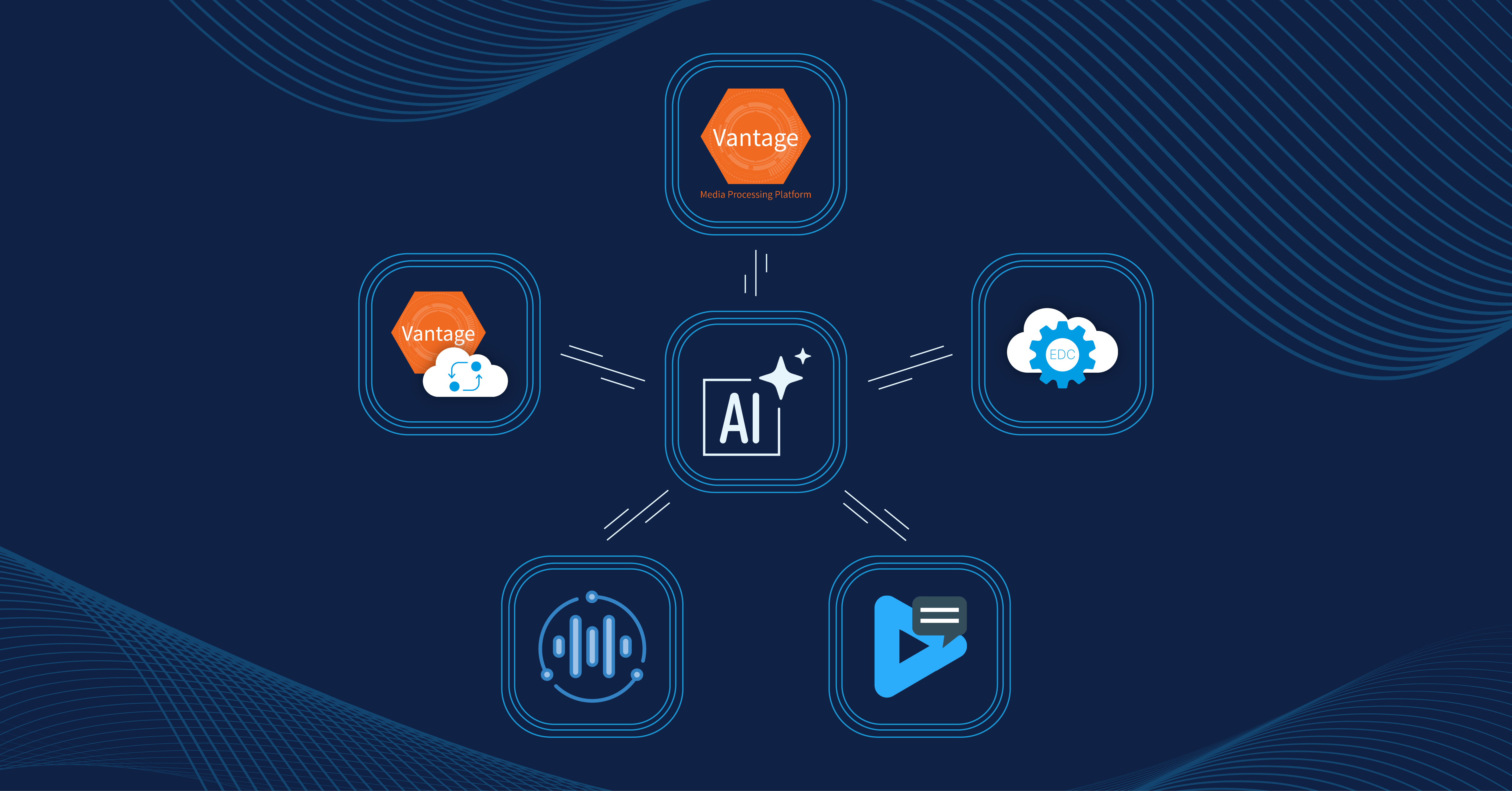

Through the integration of Omnia’s digital asset capabilities into Infinant’s Interlace platform, banks can access infrastructure designed to support stablecoin payments and tokenized deposit services. The framework aims to simplify the process for banks seeking to introduce digital asset functionality without needing to develop or maintain blockchain systems internally.

The combined platform architecture enables financial institutions to manage both traditional and digital asset transactions through a centralized payment engine. Within the same environment, banks can process conventional payment methods—including ACH transfers, wire payments, and instant payment rails—alongside stablecoin issuance and settlement.

This integrated approach is intended to reduce operational complexity while allowing institutions to expand payment capabilities as digital asset markets mature.

Accelerating Payment Innovation Through Partnerships

Riaz Syed, CEO and Founder of Infinant, stated that the collaboration demonstrates how fintech partnerships can accelerate innovation within modern banking platforms. By incorporating Omnia’s stablecoin infrastructure into the Interlace ecosystem, the platform aims to help banks explore new digital asset strategies while maintaining regulatory oversight and operational control.

The companies view the partnership as part of a broader industry trend in which banks seek flexible technology platforms that can support emerging financial products, new payment channels, and evolving customer expectations.

About Omnia

Omnia, headquartered in Denver, Colorado, provides tokenized asset infrastructure designed to help banks access digital asset opportunities. The company focuses on solutions tailored for community and regional banks, enabling services such as stablecoin on-ramps, international payments, embedded trading capabilities, and institutional settlement for both retail and commercial customers.

The platform is designed to operate within existing banking frameworks while supporting compliance and risk management requirements. By leveraging established financial systems, Omnia aims to allow banks to participate in digital asset markets while maintaining operational safety and regulatory alignment.

About Infinant

Infinant, based in Charlotte, North Carolina, develops modern banking and payments infrastructure designed to function alongside existing core banking systems. Its Interlace platform serves as an innovation layer that enables financial institutions to launch new channels, products, and partnerships while maintaining operational and regulatory control.

The platform supports capabilities such as virtual accounts, integrated payments, card services, and multi-channel banking strategies. By providing a flexible environment for financial product development, Interlace allows banks to introduce services such as embedded finance, real-time payments, tokenized deposits, and specialized account structures.

source https://newsroom.seaprwire.com/technologies/omnia-and-infinant-partner-to-expand-stablecoin-payment-capabilities-for-banks/

: Human Risk Management Solutions, Q3 2024, Living Security was recognized as a Leader, reflecting enterprise demand for telemetry-driven behavioral analytics and automated intervention capabilities.

: Human Risk Management Solutions, Q3 2024, Living Security was recognized as a Leader, reflecting enterprise demand for telemetry-driven behavioral analytics and automated intervention capabilities.