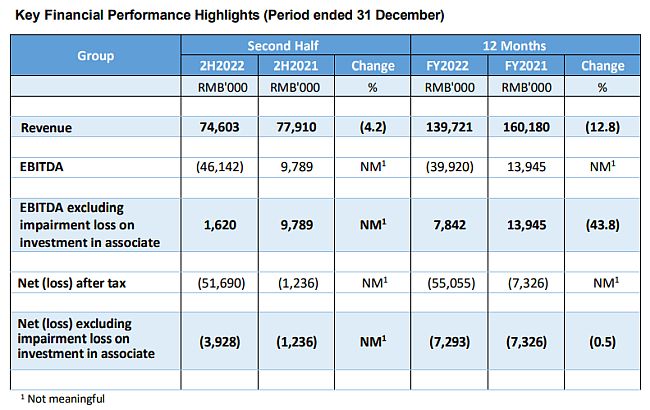

SINGAPORE, Mar 3, 2023 – (ACN Newswire via SEAPRWire.com) – Catalist listed Aoxin Q&M Dental Limited, announced on 1 March 2023, a 12.8% lower revenue of RMB139.7 million for full year ended 31 December 2022 (FY2022). The Group reported a net loss after tax excluding impairment loss on investment in our associate of RMB7.3 million for FY2022, primarily due to the number of shutdowns from China’s zero-Covid policy that was in place all the way up until 8 January 2023.

|

|

|

Dr. Shao Yongxin, Executive Director and Group Chief Executive Officer of Aoxin Q&M said, “Companies in China have had to face head-on, the challenges brought about by the COVID-19 pandemic and Aoxin is no exception. While we have recorded net loss after tax excluding impairment loss on investment in our associate of RMB7.3 million for FY2022, we are optimistic about the company’s prospects for 2023 now that China has moved from its zero-Covid stance to a “living with Covid” one. Aoxin’s primary healthcare sector has been resilient and we are well-positioned and prepared to ride the wave as the economy recovers in step with the entire country opening up.”

In addition, “Indeed, 2022 will go down as one of the most challenging years in recent history for companies operating in China, as cities and entire provinces were closed and sealed with little to no advance warning for days and sometimes weeks. Aoxin was certainly not spared and in fact, the number of days of shutdown for the Group’s hospitals and polyclinics amounted to some 844 business days in total. This includes days when some clinics could not operate because a substantial number of dentists and nurses were down with Covid themselves. Throughout this time, we have been extremely prudent in maintaining cost discipline, reducing some of our liabilities and look forward to strongly ride on the recovery in the coming year.”

Revenue

The Group’s revenue was lower by RMB20.5 million or 12.8% from RMB160.2 million for the financial year ended 31 December 2021 (FY2021) to RMB139.7 million for the financial year ended 31 December 2022 (FY2022). The lower revenue was largely due to the resurgence of Covid-19 in Liaoning Province, PRC in the second and fourth quarters of 2022 which affected all business segments of the Group.

Revenue from primary healthcare segment was lower by 7.3% from RMB93.9 million in FY2021 to RMB87.0 million in FY2022. This decrease was largely due to the temporary closure of our hospitals as instructed by the local authorities, and a decrease in number of patients visiting dental polyclinics due to dental services being classified as a non-essential service.

Revenue from distribution of dental equipment and supplies segment was lower by 22.0% or RMB11.1 million from RMB50.4 million in FY2021 to RMB39.3 million in FY2022. The lower revenue was largely due to lower demand for dental equipment from government hospitals due to lesser government tenders obtained in the six months ended 30 June 2022, partially offset by a slight increase in demand as a result of contracts secured during the six months ended 31 December 2022 (2H2022). The supply of dental equipment was also impacted by supply chain disruption as a result of Covid-19.

Revenue from laboratory services segment decreased by 15.5% from RMB15.9 million in FY2021 to RMB13.4 million in FY2022 due to decrease in demand from government dental hospitals largely due to the temporary closures.

Other income and gains were lower by 8.3% or RMB0.2 million from RMB2.9 million in FY2021 to RMB2.7 million in FY2022 mainly due to lower profit guarantees from vendors of acquired subsidiaries. However, the lower income and gains were partially offset by the higher government grant and rental discount.

Net Loss (Excluding one off impairment loss on investment in associate)

The Group’s net loss remained at RMB7.3 million for FY2022 and FY2021. The net loss of RMB7.3 million for FY2022 included tax credit of RMB5.1 million and partially offset by increase in operation loss which was largely attributable to (i) reduction in revenue by RMB20.5 million, (ii) higher % of staff costs to revenue due to regulatory increase of social insurance contributions resulting in an increase of the contribution rate, and (iii) higher unrealised foreign exchange loss arising from the translation of Singapore Dollars denominated balances to Renminbi.

Dr. Shao Yongxin added, “Our long-term growth trajectory remains intact and we will work hard to execute the strategic plans for the Group, as well as increase the revenue of our hospitals and clinics by maximising our cost efficiency of our operations.”

Dr. Ong Siew Hwa, Chief Executive Officer & Chief Scientist of Acumen and Executive Director of Aoxin Q&M added, “Acumen Diagnostics Pte Ltd (“Acumen”), will continue to progressively roll out its pipeline of new non-Covid PCR Tests. These includes the test for sepsis, identification of bacteria pathogens and their associated antimicrobial resistance in hospitalised pneumonia, as well as colorectal cancer screening and pharmacogenomics. Our colorectal cancer screening is already offered by medical practitioners to patients.

In addition, Acumen had been awarded the tender for the operation of a Joint Testing and Vaccination Centre by the Singapore Ministry of Health. The award is for a period of 15-month and expected to contribute at least S$3.6 million to Acumen’s revenue during the contract period.”

Looking Forward

Aoxin’s FY2022 results reflects the significant impact of the Covid lockdowns in China to the Group’s overall revenue. With the opening up of the entire country, the business climate and overall economy in the PRC is expected to turn positive and we thus look forward to the Group’s revenue to correspondingly improve substantially.

Building on its strong fundamentals and strength, our Group’s homegrown medical associate company, Acumen will ramp up on the implementation of its portfolio of non-Covid PCR tests in 2023.

The Group will continue to focus on disciplined management of operating expenditures, costs and capital expenditures. The Group will continue to closely monitor its expenses and maximise cost efficiency for all its operations. In addition, the Group is considering a potential fund raising exercise within the next 12 months.

Barring any unforeseen circumstances in the year ahead, we expect operations to gradually improve in 2023 as China opens up and the economy recovers. We do not foresee at this point in time, any known factors or events that may adversely affect the Group in the next 12 months.

This media release is to be read in conjunction with the Group’s announcement posted on SGXNET on 1 March 2023.

See https://links.sgx.com/1.0.0/corporate-announcements/SFUGJHC6YKNDTSVE/ce5b8462fc6d4eecd12bf30dac451fa755d625f08f9518e56256861b61b113f3

This announcement has been reviewed by the Company’s sponsor, PrimePartners Corporate Finance Pte. Ltd. (the “Sponsor”). It has not been examined or approved by the Singapore Exchange Securities Trading Limited (the “Exchange”) and the Exchange assumes no responsibility for the contents of this document, including the correctness of any of the statements or opinions made or reports contained in this document.

The contact person for the Sponsor is Ms. Lim Hui Ling, 16 Collyer Quay, #10-00 Collyer Quay Centre, Singapore 049318, sponsorship@ppcf.com.sg

About Aoxin Q&M Dental Group Limited (Stock Code: 1D4.SI) www.aoxinqm.com.sg

Aoxin Q&M Dental Group Limited (“Aoxin Q&M” or together with its subsidiaries, the “Group”) is a leading provider of private dental services in the Liaoning Province, Northern People’s Republic of China (“PRC”). The Group operates 16 dental centres, comprising 10 dental polyclinics and 6 dental hospitals, located across 8 cities in Liaoning Province, namely Shenyang, Huludao, Panjin, Gaizhou, Zhuanghe, Jinzhou, Dalian and Anshan.

A majority of the dental centres are accredited as Designated Medical Institutions of Medical Insurance. Additionally, the Group is engaged in the provision of dental laboratory services, as well as the distribution and sale of dental equipment and supplies in the Liaoning, Heilongjiang and Jilin Provinces in Northern PRC.

Aoxin Q&M was listed on the Catalist board of the Singapore Exchange Securities Trading Limited on 26 April 2017.

Media and Analysts please contact the below for more information:

Waterbrooks Consultants Pte. Ltd.

+65 6958 8008, query@waterbrooks.com.sg

Wayne Koo (M): +65 9338 8166, wayne.koo@waterbrooks.com.sg

Derek Yeo (M): +65 9791 4707, derek@waterbrooks.com.sg

Copyright 2023 ACN Newswire. All rights reserved. (via SEAPRWire)

source https://netdace.com/acn-newswire/catalist-listed-aoxin-qm-reports-lower-revenue-of-rmb-140m-for-full-year-ended-31-december-2022/