|

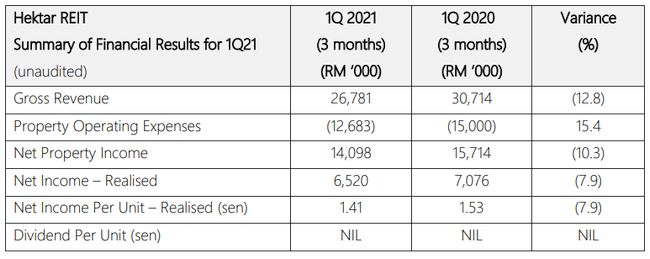

Hektar REIT recorded revenue of RM26.78 million, which is 12.8% lower than the RM30.71 million recorded in the same quarter of the preceding year. The reported revenue fell mainly due to the rental income, carpark income and lower hotel occupancy, consistent with other retail and hospitality REITs that were affected because of the pandemic outbreak and implementation of mobility restrictions. Net property income of RM14.09 million for the quarter decreased by 10.3% compared to the RM15.71 million recorded in 1Q 2020. Realised income for the quarter was RM6.52 million, which is 7.9% lower than the RM7.08 million recorded in 1Q 2020. Earnings Per Unit ("EPU") of 1.41 sen was recorded for the first quarter.

Dato' Hisham bin Othman, Chief Executive Officer of Hektar Asset Management Sdn. Bhd, commented: "The retail front continues to be really challenging due to the rise in COVID-19 infections. Despite most businesses being allowed to operate under the second movement control order ("MCO") from mid-January to early March, a combination of movement restrictions and fear of infection has affected visitor footfall in malls."

"Retail sales growth has also been affected due to the second MCO, with Retail Group Malaysia estimating sales growth of 4.1% for 2021 compared to the earlier estimate of 4.9%. With the rise in COVID-19 cases, the Government published the first list of premises flagged as potential COVID-19 hotspots that were identified through the Hotspots Identification for Dynamic Engagement ("HIDE") system. Many prominent shopping malls in the Klang Valley, which included Subang Parade, were listed under HIDE and were required to temporarily close for 3 days to undergo sanitisation upon the directive from the Government from 9 May to 11 May 2021. The recent imposition of the third MCO is expected to further affect the retail sales growth with restrictions on no dine-in for F&B outlets and closure of beauty services and entertainment outlets."

"However, we expect economic recovery to accelerate as consumer sentiment improves over the second half of 2021 as more people get vaccinated. We will continue following the stringent SOPs by the Government and engage with our tenants across the portfolio to help promote their business while ensuring the health and safety of all visitors, tenants and employees remain our top priority".

About Hektar Real Estate Investment Trust

Hektar Real Estate Investment Trust ("Hektar REIT") is Malaysia's first listed retail-focused REIT. The primary objectives of Hektar REIT are to provide unitholders with sustainable dividend income and to achieve long-term capital appreciation of the REIT. Hektar REIT was listed on the Main Market of Bursa Malaysia Securities Berhad on 4 December 2006 and currently owns 2 million square feet of retail space in 4 states with assets valued at RM1.2 billion as at 31 December 2020. The REIT's strategic partner is Frasers Centrepoint Trust, part of Frasers Property Ltd, headquartered in Singapore. Hektar REIT is managed by Hektar Asset Management Sdn Bhd and the property manager is Hektar Property Services Sdn Bhd. Hektar REIT's portfolio of commercial properties includes Subang Parade in Subang Jaya, Selangor; Mahkota Parade in Melaka; Wetex Parade & Classic Hotel in Muar, Johor; Central Square in Sungai Petani, Kedah; Kulim Central in Kulim, Kedah and Segamat Central in Segamat, Johor. For more information, please visit www.HektarREIT.com

Contact:

Muhammad Hakim

Swan Consultancy

M: +60 12 318- 5410

E: h.juraimi@swanconsultancy.biz

Copyright 2021 ACN Newswire. All rights reserved. www.acnnewswire.com

source https://www.acnnewswire.com/press-release/english/66808/