|

|

|

|

|

|

|

|

|

Newborn Town, after shifting its focus to social business in 2020, has achieved strong results in its business operations and aggressive acquisition and expansion strategies, acquisition of MICO and layout of mid- and hard-core games, leading to Newborn Town's impressive outperformance in its stock price in the past two years.

It is not hard to understand why Newborn Town's stock price has increased sharply by 186% from HKD1.8 to HKD5.14 since the beginning of this year. It should be noted that Newborn Town has been leading the e-commerce and Internet sectors in the Hong Kong stock market, and therefore, is well-deserved as one of the best performing Hong Kong stocks this year.

Newborn Town grows in line with the law of the Internet industry

There is a law in the Internet industry which was proposed by Robert Metcalfe, the inventor of the Ethernet, and was named after him as Metcalfe's Law. According to Metcalfe's Law, the value of the network is proportional to the number of network users squared.

As shown in Newborn Town's latest Interim Financial Report, the number of overseas users remained on a stable and high rise while cumulative downloads of social apps reached 254 million through June 30 2021, with 17.41 million Monthly Active Users (MAU) on average during 1H2021, increasing by about 38% from 2H2020.

In response to the rapid growth in the number of users, Newborn Town recorded revenue of RMB1.04 billion and a net profit of RMB0.14 billion in the first half of the year, showing a year-on-year increase of nearly 6 times and nearly 40 times respectively.

In fact, in spite of Newborn Town's excellent financial performance, what investors in the Internet sector value most is not a company's short-term revenue and profit, but the sustainability of its user growth. This is because expansion of user groups of social products and diversified monetization methods will surely bring about rapid growth in operating revenue.

The rapid growth in Newborn Town's revenue not only benefits from the sharp increase in the number of users, but also from the constantly diversified social product portfolio and the improvement of its operational efficiency.

It is widely held that Newborn Town is an "upstart" standing out from Chinese Internet companies having established business operations in foreign markets. In fact, it is not. Newborn Town began to expand its business to foreign markets in 2013 and began to deploy its social business in 2015. Its audio and video social platforms such as MICO and YoHo having been downloaded more than 200 million times worldwide, with more than 18 million MAU on average in the second quarter of 2021.

The Gulf countries in the Middle East contribute a great deal to Newborn Town's revenue. For example:

- In Saudi Arabia, MICO and YoHo ranked 10th and 8th respectively among the top-grossing social apps in Google Play, and ranked 7th and 6th respectively among the top-grossing social apps in App Store.

- In the UAE, YoHo and MICO ranked 5th and 11th among the top-grossing social apps in Google Play, and MICO ranked 4th among the top-grossing social apps in App Store.

From statistics released by Sensor Tower, we know:

- Newborn Town's products rank among the top-grossing in social app rankings in many countries worldwide, which provides reliable evidence for the company's satisfactory performance data.

- Newborn Town's products are very popular in many countries worldwide, indicating that the product and operational strategies applied by the company work well.

If everything goes well, Newborn Town's next important strategy is to focus on social traffic, further develop mid- and hard-core games, increase user stickiness and monetization rate, make its business layout in the game market by using the "independent research + release + investment" strategy, place emphasis on quality products, and increase the monetization efficiency.

Underestimated Newborn Town, Neglected High Growth

Based on the user and market data above, although Newborn Town's stock price rose sharply by 15.58% on August 24, we believe that its closing price of RMB5.14 on August 25 is substantially undervalued by the capital market.

At market's close on August 25, Newborn Town's market capitalization reached HKD5.13 billion, equivalent to RMB4.26 billion. However, considering its expected annual revenue of about RMB2.1 billion, Newborn Town had a price-to-sales ratio of about 2.03x in the capital market.

Therefore, Newborn Town, a high-growth stock in the Internet sector, which has its revenue and net profit increasing by about 590% and 4000% year-on-year respectively and has the number of its half-year average MAU increasing by nearly 40%, has an extremely conservative valuation with a price-to-sales ratio of about 2x, as it may go for stocks in the banking and insurance sectors.

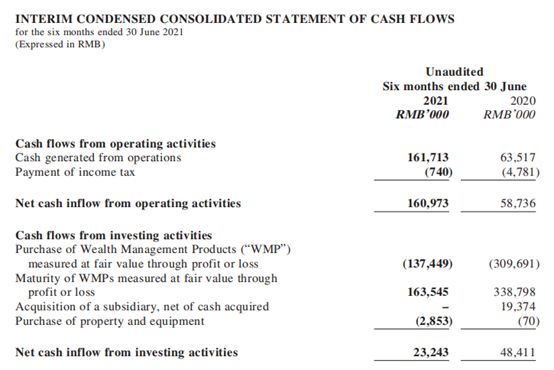

Look at Newborn Town's cash flow statement. According to its annual report 2020, Newborn Town had net cash inflow from its operating activities in 2020 totaling RMB300 million, net cash outflow from its investment activities in 2020 totaling RMB97 million, and annual net cashes in 2020 of over RMB200 million. According to its interim report in 2021, in the first half of this year, Newborn Town had net cash inflow from its operating activities totaling RMB160 million, net cash inflow from its investment activities totaling RMB23 million, and net cashes of over RMB180 million.

It seems inconsistent that a company with rapid growth in user groups and with sound cash flows should receive such a low valuation.

What's more, Newborn Town's potential high-growth factors have not yet been included in the foregoing. For example, since the second quarter of this year, Newborn Town has focused on Japanese, South Korean and other developed markets, and began to expand MICO and other products into those markets. In another example this year, Newborn Town attached great importance to mid- and hard-core games and is releasing independently developed quality games, and is making initial investments in several game businesses which may exert influence on its current profit but will greatly drive Newborn Town's future growth.

Value recognition may be late, but will never be absent. We believe the value of Newborn Town will be recognized at some point by the capital market, and so advise investors to take the long view.

Behind Newborn Town's expansion to foreign markets: the victory of Internet industry players in China

According to data from Sensor Tower, in 2020, the total revenue of Chinese social apps launched in global markets increased by 127% from the previous year and the total revenue of Chinese entertainment apps launched in global markets increased by 250% from the previous year. As shown in the data from Analysys International, MICO ranked top five Chinese going-global entertainment and social apps contributing at least USD100 million to corporate revenue in 2020.

Since the beginning of 2021, Chinese apps have enjoyed worldwide popularity, especially social and game apps. Keeping up with this historical trend, Newborn Town has launched dozens of social, games and other apps widely used worldwide, and based on the average MAU of its social apps, it has become the largest Chinese company to have expanded its social networking business to foreign markets.

We believe that the value of Newborn Town Inc. (9911.HK) will be re-evaluated by the capital market. With its current valuation and potential for future growth, both of which are quite attractive, Newborn Town presents a great opportunity in the context of market recovery.

Contact:

Weijie Xie, Peanutmedia

E: xieweijie@czgmcn.com

URL: www.Peanutmedia.com

Copyright 2021 ACN Newswire. All rights reserved. www.acnnewswire.com

source https://www.acnnewswire.com/press-release/english/69106/